Self-Inquiry Report

A Self-Inquiry Report (SIR) is your credit report that contains details of credit information that you have taken up from different financial and non-financial institutions, such as credit card; car, home, personal, or education financing; electric bills; telephone bills; and internet subscription.

Why is it important?

Checking your credit report can be considered as a 'Financial Health Check' which allows you to see how you have managed your finances and repaid your debts over time.

Your credit report can help increase the confidence of lenders and improve your chances of obtaining credit. It is recommended to check your credit report at least once a year. This will allow you to verify and rectify the information that is shown in your credit report.

Another good rule of thumb would be to check your credit report prior to applying for credit to ensure all information are updated and reflected correctly.

Who can access my Self-Inquiry Report?

- Any individual will be able to access his or her own credit report

- Any commercial company for its own credit report.

Requesting for an SIR

For Individuals

For individuals, you may now obtain your SIR online. If it is your first time obtaining your credit report online, you are required to firstly register for an online SIR. Click here for the guideline on how to get your credit report.

Online Access

Individuals can now register for their Self-Inquiry Report online anytime, anywhere at their convenience.

No physical presence required

Individuals will not be required to go to the Credit Bureau Customer Service Office for report collection.

Valid identification documents

Individuals will need to submit a valid identification document [either identity card or passport].

For verification purposes, the individual will also be required to submit this together with a self-portrait.

Payment

Each report is BND3.00. Payments can be made using a debit or credit card.

For Businesses

For business, you may now obtain your SIR online. If it is your first time obtaining your credit report online, you are required to firstly register for an online SIR.

Call +673 233369.

You will then receive an SMS to confirm your appointment.

Upon arrival at the Credit Bureau Customer Service Counter (Level 7, Ministry of Finance and Economy Building), you will need to complete a form and present the required documents.

Required Documents

Sole Proprietorship & Partnership

- Certificate 16 & 17

- Original document of a valid national identity card (ID) of any of the sole proprietor or partners

Company (Public/Private/Foreign)

- Certificate of incorporation

- List of Directors Particulars (Form X)

- Original document of the Board of Resolution/Circular Resolution

- Original document of a valid identity card (ID) or a valid passport of any of the Directors/Chief Executive Officer/Chief Financial Officer/Company Secretary

Cash payment of BND5.00 will be requested and the Self-Inquiry Report will be printed.

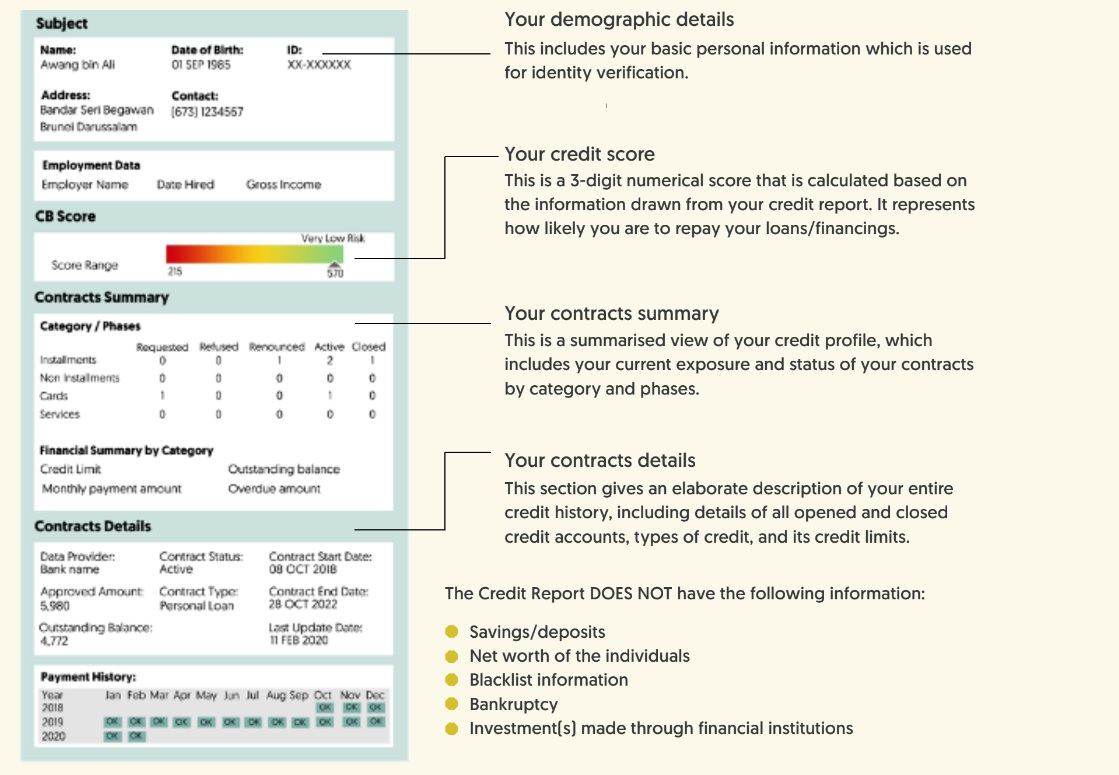

Contents of Self-Inquiry Report

What are the contents of your SIR?

The Credit Bureau DOES NOT APPROVE NOR REJECT a borrower's loan application. It also DOES NOT express any opinion, suggestions or recommendations about the credit-worthiness of the borrower in the credit report.

Credit Information

The Credit Bureau collects comprehensive, both positive and negative credit information (banking and utility data) on individuals and commercial entities on a regular basis from the relevant data providers.

Positive Information includes details on an individual's credit account/s such as type of credit limit and payment history. It also includes outstanding debts, repayment history and other credit-related information that can indicate a borrower's credit-worthiness.

Negative Information refers to the details on any missed or late payments, default accounts, or other credit-related events that can negatively impact a borrower's credit score. This information provides lenders with a view of any potential risks associated with lending to a particular borrower.

All data are 100% from the data providers. The Credit Bureau does not change nor modify any submitted data. Any correction on incorrect data are the responsibility of the data providers.

Banking Data

All licensed banks, finance companies and the Islamic Trust Fund in Brunei Darussalam submits credit information to the Credit Bureau on a fortnightly basis. This includes the following:

Basic personal information that Credit Bureau and data providers use to verify your identity:

- Name;

- Former names (if it has been changed);

- Current and previous addresses;

- Date of birth; and

- Employer

Credit facility records of every loan and credit card in your name. Each record will list:

- Type of credit facilities. For example: car loan, home loan, education loan, overdraft, credit card, etc;

- Date of credit facility opened;

- Lender you have a credit account with;

- Credit limit or loan amount;

- Outstanding balance;

- Payment history;

- Credit application enquiries with prospective lender;

- Dishonoured cheques due to insufficient fund (if any); and

- Legal suits file by data providers (if any).

All credit information listed in the credit report are those accounts with active status as of January 2010.

Utility Data

Utility companies, such as telecommunication companies (telcos) and water services, provide "credit-like" services. “Credit-like" services refer to those that are similar to credit where there is a provision of goods or services in exchange for a promise of payment in the future.

Data from the utility companies are submitted to the Credit Bureau on a monthly basis and includes the following historical information:

- Name;

- Former names (if it has been changed);

- Current and previous addresses;

- Date of birth; and

- Employer

How is it useful?

Utility data can give a beneficial edge, in terms of credit accessibility, to those who have yet or have little established relationship with financial institutions – in particular, "thin file" borrowers (i.e. borrowers with little credit history) and "null file" borrowers (i.e. borrowers with no credit history).

Utility data serves as value-added information inside the credit report, which means the financial institutions will have alternative means of evaluating the credit-worthiness of their existing and prospective borrowers.

Bureau Credit Score

A Bureau Credit Score is a numerical expression to represent the odds or probability that a borrower will become a "bad payer", at a particular point in time that will help the banks and finance companies to assess the borrower's credit risk. The calculation of the Bureau Credit Score is based on the Probability of Default model, of which primarily derived from an analysis of the borrower's historical credit performance.

A high score indicates that the borrower has a low credit risk, i.e. always making prompt payments and have never missed a payment. Someone with a low credit score is considered as a high risk borrower, having a greater risk of missing payments or defaulting.

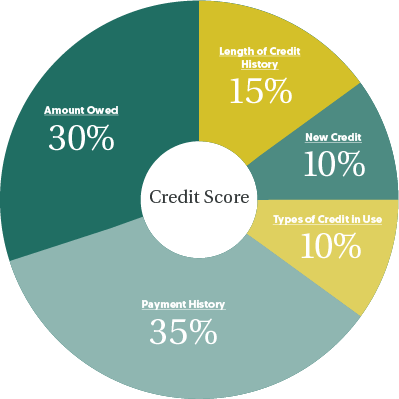

Components of a Credit Score

The score is calculated based on the credit-related data available in the Bureau’s repository, and is made up of five factors:

Length of Credit History

The longer your record of good history is, the better your credit score will be. A long credit history makes it easier for banks and finance companies to see how well you’ve managed credit in the past.

Payment History

Banks and finance companies can see how reliable you are as a borrower from your repayment history. They rely heavily on an individual’s loans/ financing repayment history as it’s often used to predict the individual’s repayment behaviour in the future. The score also takes into account how consistent and timely your payments are for both revolving (credit cards) and instalment loans (such as home mortgages or vehicle financings).

New Credit

Borrowers should avoid opening too many credit lines at the same time, as this could suggest they are in financial trouble. You should only take on additional credit when you really need it, or when it makes sense financially!

Types of Credit in Use

Types of loans and credit cards you hold – secured credit (home, car loans) versus unsecured credit (credit cards, personal loans).

Amount Owed

Your credit score shows how much outstanding debt you have compared to the amount of credit you’re entitled to. Individuals with numerous, completely maxed out credit lines showcase an image of someone that cannot manage their debt responsibly, and will likely have a negative impact on his credit score.

To show that you are a reliable borrower, the debt utilisation ratio should be kept as low as possible. Maintaining that low ratio applies to both individual lines of credit and the total amount of loans.

The debt utilisation ratio is the percentage of a borrower’s total available credit currently being used. The calculation represents the total debt used in comparison to total revolving credit, and lowering the ratio can help a borrower improve their credit score.

Here’s an example on how to calculate a debt utilisation ratio! Imagine a borrower has three credit cards, with different revolving credit limits.

Card 1

Credit limit BND3,000, and an outstanding balance of BND500

Card 2

Credit limit BND7,000, and an outstanding balance of BND5,000

Card 3

Credit limit BND10,000, and an outstanding balance of BND3,000

BND8,500

Total credit used

BND20,000

Total revolving credit across all three cards

42.5%

Credit utilisation ratio

Key Benefits of a Good Credit Score

Fairer and objective credit assessments

Faster credit decisions, as credit providers can distinguish between high and low risk borrowers

Improved access to credit, based on your score proving your financial security and being creditworthy

Allows you to negotiate for better terms of financing