Islamic Finance Development

Islamic finance has become one of the key sectors in Brunei Darussalam's financial services industry. Prominent for its strong Islamic philosophy, Brunei Darussalam envisions itself to become an international Islamic financial hub. In light of this, BDCB continues to support the development of a sound and progressive financial sector, and in doing so, has identified Islamic finance as a key focus in its Financial Sector Blueprint 2016-2025.

Brunei Darussalam embarked on its Islamic finance journey with the establishment of the first Islamic financial institution in 1991. Three decades later, the Brunei Darussalam Islamic financial sector has multiplied in terms of the number and types of financial institutions.

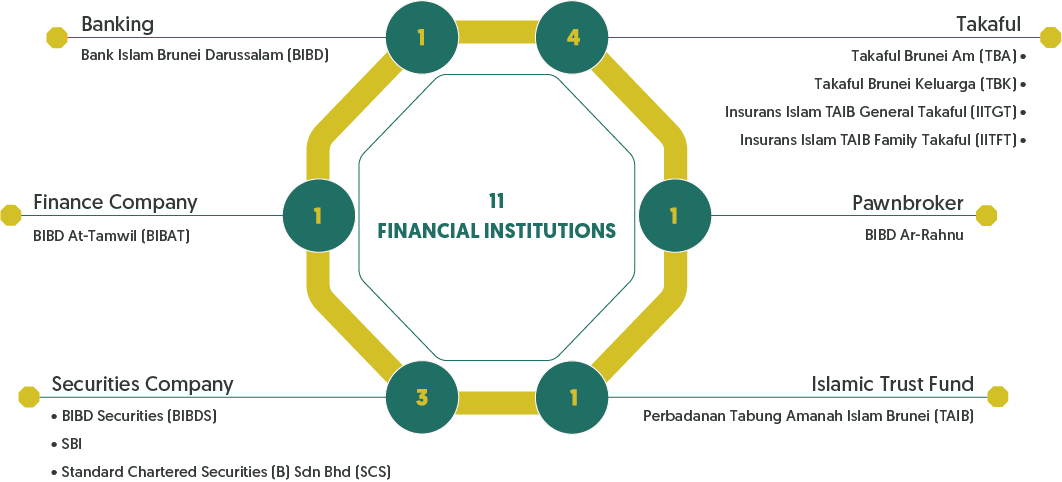

Brunei Darussalam's Islamic finance industry currently comprises 11 financial institutions.

In addition to the FSBP, BDCB also introduced the Brunei Darussalam Islamic Finance (BDIF) initiative in 2017 to support His Majesty the Sultan dan Yang Di-Pertuan of Brunei Darussalam's aspiration for the Sultanate to become an international hub for Islamic finance. BDIF aims to showcase the Sultanate's Islamic finance eco-system since 1991. Information on Brunei Darussalam's end-to-end regulations relating to Islamic finance, market players and their products, as well as educational and training resources to support continuous professional development can also be found on the BDIF website.

Regulatory Landscape in Islamic Finance

Brunei Darussalam has a dual financial system consisting of conventional and Islamic Finance.

At present, Brunei Darussalam has a two-tier Syariah governance structure comprising of:

- A centralised Syariah Financial Supervisory Board (SFSB), for which Syariah Finance, BDCB is the secretariat. The SFSB is established under the Syariah Financial Supervisory Board Act, Cap 295. It has a mandate to ascertain the Islamic law on any financial matter, to issue rulings on matters referred to it, and to advise on any Syariah issues relating to Islamic financial business, activities or transactions.

- The Syariah Advisory Body (SAB) at the institutional level plays a complementary role to the Syariah Financial Supervisory Board. Its role is to advise the institution on Syariah compliance of banking operations.

Islamic finance activities are governed under the Islamic Banking Act (Cap 168) for Islamic banks, Takaful Order (2008) for the takaful sector and Islamic capital market activities are governed under the Securities Market Order, 2013, and its supplementary legislation the Securities Markets Regulations, 2015 (SMR). These legislations are administered by BDCB providing BDCB the authority to supervise and regulate them in a manner that maintains financial stability. Islamic finance institutions are subject to the same prudential standards and reporting requirements as conventional financial institutions.

BDCB has also introduced additional regulatory requirements that the Islamic Financial Institutions need to comply. These include the Syariah Financial Supervisory Board Act (SFSB), Cap 295, Notice and Guidelines to Financial Institutions on Syariah Governance Framework, Guidelines on Internal Syariah Audit Framework and Guidelines on The Islamic Product Approval Process under Section 14 of Syariah Financial Supervisory Board Act, Cap 295.

Secretariat to the Syariah Financial Supervisory Board

The Syariah Financial Supervisory Board (SFSB) Act, Cap 295 came into force on 16 Zulhijjah 1426 corresponding to 17 January 2006. It provides a framework for the control of administration and business dealings of financial institutions concerning Islamic products and any Islamic financial matters including Islamic banking business, takaful business, Islamic financial business, Islamic development financial business, and any other business relating to Syariah principles.

BDCB, through Syariah Finance, is the Secretariat to the SFSB. Syariah Finance is also responsible in ensuring that Islamic financial institutions businesses are in accordance to Hukum Syara'.

For the list of Syariah Scholars and Islamic Finance Experts, please click here.

Milestones

Click or drag on the year to find out about the Islamic finance development milestones.