Monetary Operations

Payment and Settlement Systems

Overview

Safe, reliable and efficient financial market infrastructures are key components of the financial system to support financial stability and foster economic growth. BDCB operates the National Payment and Settlement Systems (NPSS) of Brunei Darussalam which consist of the Real-Time Gross Settlement (RTGS) system, the Automated Clearing House (ACH) system and the Central Securities Depository (CSD) system.

The Real-Time Gross Settlement (RTGS) System

The RTGS system, which came into operation in 2014, is the heart of a modern national payment system and is designed to meet the global criteria for systemically important payment systems.

The RTGS system is an Interbank funds transfer system which allows large-value and urgent payments between banks take place in real-time and settled on an individual basis.

All interbank payments are settled using funds available in the Brunei Dollar settlement account held directly with BDCB. Once settled, all payments are final and irrevocable.

The Automated Clearing House (ACH) System

The ACH system is an electronic retail payment system that facilitates bulk clearing of debit and credit instruments for its members. Payment obligations are netted at the end of each clearing session and submitted to the RTGS system for settlement. The ACH system was launched in May 2016 replacing the manual Cheque Clearing House. It enables banks to convert the physical cheques to digital images and submit the electronic payment files to the ACH system for clearing and settlement.

The ACH system also clears bulk direct credit transfers, such as payrolls, for low-value and less urgent interbank payments.

The Central Securities Depository (CSD) System

The CSD system was implemented in May 2017 for the electronic registration and maintenance of records for Government debt securities, replacing the manual book entry processes. It also enables the auction of new Government securities, settlement of securities transfers and provides a trading platform to facilitate electronic trading in the secondary market as well as collateral management functionalities.

Minimum Cash Balance

The Minimum Cash Balance [MCB] requirement is applicable to banks licensed under the Banking Act, Cap 95 and Islamic Banking Act, Cap 168.

| MCB Requirement | 5% of eligible liabilities |

|---|---|

| Averaging Provision | 50% of daily MCB requirement |

Overnight Standing Facilities

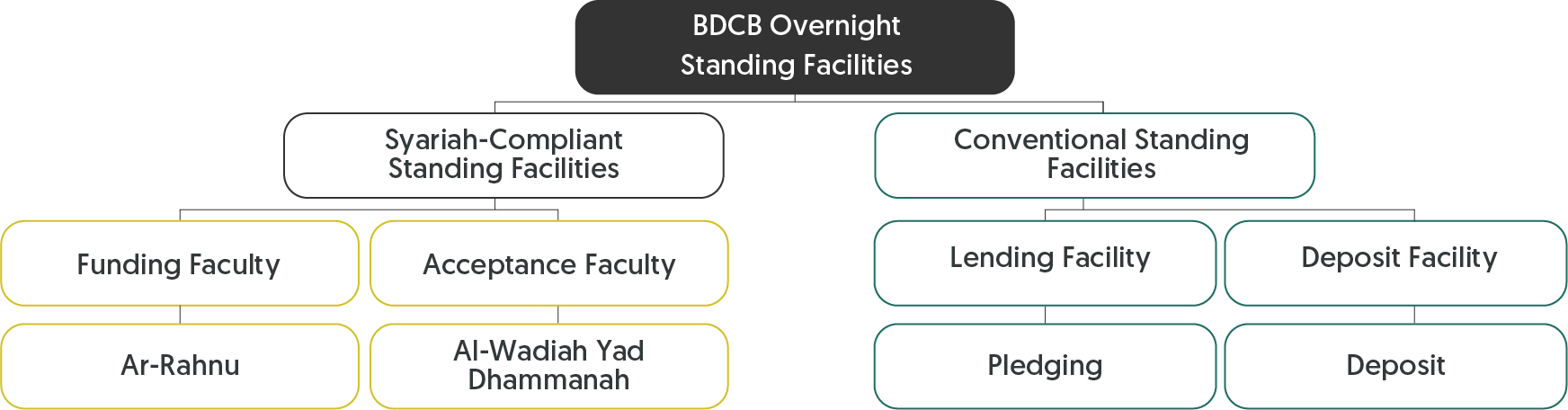

The Overnight Standing Facilities are fundamental tools for effective and efficient liquidity management for the banks and the development of the domestic money market. The Facilities consist of Syariah-Compliant Funding and Acceptance Facilities, and Conventional Lending and Deposit Facilities.

| Types | Overnight Syariah-Compliant Standing Facilities | Overnight Conventional Standing Facilities | ||

|---|---|---|---|---|

| Funding Facility | Acceptance Facility | Lending Facility | Deposit Facility | |

| Instrument | Ar-Rahnu | Wadiah Yad Dhamanah | Pledging | Deposit |

| Objective | Provision of Brunei Dollar liquidity to bank against eligible collateral | Placement of excess Brunei Dollar liquidity with BDCB | Provision of Brunei Dollar liquidity to bank against eligible collateral | Placement of excess Brunei Dollar liquidity with BDCB |

| Tenor | Overnight | Overnight | Overnight | Overnight |

| Establishment of Fees/Rates | Safekeeping Fee | Any hibah paid will be at the absolute discretion of the BDCB | Lending Rate | Deposit Rate |

| Collateral |

|

- |

|

- |

| Counterparties | Licensed Islamic and Conventional Banks in Brunei Darussalam | Licensed Islamic and Conventional Banks in Brunei Darussalam | Licensed Conventional Banks in Brunei Darussalam | Licensed Conventional Banks in Brunei Darussalam |

The Overnight Standing Facilities rates are determined by the Financial and Monetary Stability Committee (FMSC). The Committee meets monthly and is responsible for monitoring the risks present in the global and domestic financial and economic environment, and provides policy recommendations to BDCB's Board of Directors.

For more information:

BDCB I-Bills

In 2020, BDCB introduced the BDCB I-Bills Programme which aims to build a benchmark yield curve, facilitate the development of other financial instruments in Brunei Darussalam, and widen the list of available money market instruments for BDCB and the domestic financial sector.

| Issuer | Al-Munawwarah Sdn Bhd (Special Purpose Vehicle) |

|---|---|

| Tenor | 2 weeks and 4 weeks |

| Issuance Frequency | 2 weeks (every fortnight), 4 weeks (every month) |

| Currency | BND |

| Structure | Wakalah |

For more information:

Brunei Government Sukuk Al-Ijarah

BDCB, as the agent to the Government of His Majesty the Sultan and Yang Di-Pertuan of Brunei Darussalam, is responsible for the management and administration of the Brunei Darussalam Government Sukuk Al-Ijarah issuances. The objective of this programme is to develop the Brunei Darussalam Government securities yield curve as a benchmark for corporate sukuk, and provide a safe and liquid investment instrument for domestic financial institutions.

| Issuer | Sukuk Brunei Sdn Bhd |

|---|---|

| Tenor | 3 months, 12 months, 3 years, 5 years, 7 years, and 10 years |

| Issuance Frequency | At least once a month |

| Currency | BND |

| Structure | Sukuk Al-Ijarah |

For more information: